XRP Price Prediction: Technical Setup and Market Momentum Suggest $3 Breakout Imminent

#XRP

- Technical Momentum: MACD bullish crossover and proximity to key moving averages suggest building upward pressure toward the $3 resistance level

- Fundamental Support: Regulatory clarity post-SEC settlement, institutional accumulation, and expanding utility through new mining features provide strong underlying support

- Market Sentiment: Positive news flow including ETF speculation, SWIFT challenger positioning, and analyst predictions of significant price appreciation create favorable conditions for突破 psychological barriers

XRP Price Prediction

Technical Analysis: XRP Approaches Critical Resistance Level

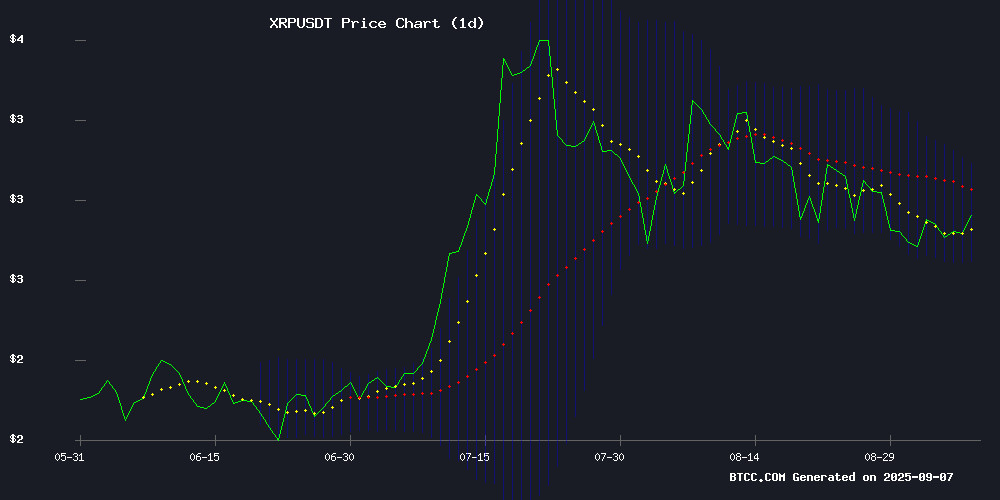

XRP is currently trading at $2.8813, slightly below the 20-day moving average of $2.8899, indicating near-term consolidation. The MACD reading of 0.1219 above the signal line at 0.1190 suggests building bullish momentum, though the modest histogram value of 0.0030 shows this momentum remains early-stage. Bollinger Bands position the price between support at $2.7022 and resistance at $3.0776, with the middle band at $2.8899 serving as immediate resistance.

According to BTCC financial analyst William, 'XRP's technical setup shows it's testing key levels. The proximity to the upper Bollinger Band at $3.0776 represents the primary technical hurdle for reaching $3. A sustained break above the 20-day MA could provide the foundation for testing this critical resistance.'

Market Sentiment: Bullish Fundamentals Support XRP Momentum

Recent developments create a favorable backdrop for XRP's price appreciation. The resolution of Ripple's SEC settlement has positioned the company as a potential SWIFT challenger, while institutional accumulation has driven prices above $2.90. New mining features from SitonMining and emerging pair trade opportunities with MAGACOIN FINANCE add utility and trading volume.

BTCC financial analyst William notes, 'The combination of regulatory clarity, institutional adoption, and expanding use cases creates strong fundamental support. While technical resistance at $3 exists, the underlying sentiment driven by ETF speculation and supply dynamics provides compelling reasons for Optimism about breaking through this psychological barrier.'

Factors Influencing XRP's Price

Legal Expert Denies Coinbase Affiliation Amid XRP Sell-Off Controversy

Bill Morgan, a prominent pro-crypto legal analyst, forcefully rejected erroneous media claims labeling him as a Coinbase attorney. The misidentification occurred following his commentary on allegations of XRP price manipulation linked to Coinbase's reported 69% reduction in holdings. "This is an insult I do not accept," Morgan declared on social media platform X, emphasizing his lack of professional ties to the exchange.

Market observers have scrutinized Coinbase's substantial XRP divestment, with some suggesting potential market influence. Morgan's intervention in the debate appears to have triggered the misattribution, despite his statements representing personal analysis rather than institutional positions. The incident highlights growing tensions around exchange transparency in cryptocurrency markets.

Ripple Emerges as SWIFT Challenger Following SEC Settlement

Ripple's protracted legal battle with the U.S. Securities and Exchange Commission concluded in August 2025, marking a watershed moment for the blockchain payments company. The $125 million settlement delivered regulatory clarity for XRP - a rare commodity in the cryptocurrency space - coinciding with renewed institutional interest.

BlackRock's prominent participation at Ripple's Swell 2025 conference signals growing mainstream acceptance. Analysts note XRP accumulation has hit a 24-month peak, with price projections reaching $5 by year's end. Meanwhile, Saudi Arabia's central bank has begun piloting Ripple's xCurrent technology, challenging SWIFT's dominance in cross-border transactions.

The legacy financial network processes 53 million daily messages but contends with operational inefficiencies. Industry observers anticipate coexistence rather than displacement, with SWIFT reportedly planning its own XRP integration tests. Market sentiment appears bullish, with some forecasts suggesting a $127 valuation horizon for XRP.

XRP Surges Past $2.90 Amid Heavy Accumulation

XRP rallied sharply on Sunday, breaching the $2.90 level after a concentrated buying spree of over 10 million tokens within 15 minutes. The surge, amplified by thin weekend liquidity, marks the highest accumulation activity in two years.

Kraken dominated the buying pressure with 5 million units traded, followed by Coinbase and Binance. Network Value to Transactions ratios now flash overvaluation signals—a potential warning for short-term traders.

SitonMining Introduces XRP Mining Feature, Enabling Stable Cash Flow from Holdings

SitonMining, a leading global digital asset mining platform, has launched XRP mining, offering investors a novel way to generate sustained returns from their holdings. Unlike traditional minable assets like Bitcoin and Ethereum, XRP's value has historically been tied to its utility in cross-border payments and high-speed transfers.

The platform's innovative approach allows users to convert idle XRP into productive assets through mining plans. This "holding yields" model shifts the investment paradigm from speculative price appreciation to consistent income generation. Market demand for XRP in financial applications continues to grow, making this development particularly timely.

SitonMining's liquidity management mechanisms address volatility concerns by creating structured yield opportunities. The move reflects broader industry trends where crypto assets increasingly serve dual purposes as both investment vehicles and revenue-generating instruments.

XRP and MAGACOIN FINANCE Emerge as 2026 Crypto Standouts Amid Bullish Predictions

XRP's technical setup suggests a potential surge to $5 as it consolidates within a bullish flag pattern. A decisive close above the $3 resistance level would confirm the breakout, though the 50-day SMA at $3.08 poses an immediate challenge. The token faces additional hurdles at $3.40 and its July 18 peak of $3.66 before reaching the projected target.

Meanwhile, MAGACOIN FINANCE enters the spotlight as a dark horse candidate, with its $0.10 entry point drawing comparisons to early-stage opportunities in previous cycles. The project's $7 price projection implies life-changing returns for early backers, though such predictions remain speculative in nature.

Ripple vs. BlockchainFX: The 2025 Crypto Showdown for Passive Income and ROI

Investors eyeing the 2025 crypto landscape are weighing two divergent opportunities: Ripple (XRP), the established cross-border payments player, and BlockchainFX (BFX), an emerging super app challenger. While XRP banks on institutional adoption, BFX's $6.8M presale momentum signals retail enthusiasm for its all-in-one trading platform.

BlockchainFX's value proposition hinges on vertical integration—combining crypto, stocks, and commodities in a single interface. This contrasts sharply with XRP's narrower focus on banking partnerships. At $0.022 during presale versus XRP's mature valuation, BFX offers asymmetric growth potential, though with commensurate risk.

XRP Faces Resistance at $3 as Rollblock Emerges with 580% Presale Surge

Ripple's XRP struggles to break the $3 resistance level despite a new partnership with Air China, while Rollblock captures market attention with a 580% presale rally. XRP's price hovers near $2.84, trapped in a descending triangle pattern. A breakout could target $3.40, but failure risks a retreat to $2.70 support.

Meanwhile, Rollblock's gaming-focused protocol has attracted over 50,000 investors during its presale phase. The project's deflationary tokenomics and on-chain utility contrast with XRP's regulatory challenges, positioning it as a potential high-growth alternative for 2025.

Analyst Predicts $50 XRP by 2025 Citing ETF Approvals and Supply Dynamics

Veteran investor Pumpius projects a $50 price target for XRP by December 2025, contingent on SEC approval of multiple spot ETF filings currently under review. Six major asset managers—including Bitwise, WisdomTree, and Franklin Templeton—have active applications clustered around a late October 2025 decision window.

The analysis hinges on a potential demand shock from institutional inflows, with estimates suggesting $5 billion in first-month ETF purchases. Such volume could strain XRP's effectively thin free float, given 35 billion tokens remain in escrow and concentrated holdings among exchanges and whales.

Market structure appears primed for volatility. Approval of multiple ETFs in October's decision cluster would create simultaneous catalysts, while rejections could trigger broad selloffs. The calculus assumes regulatory clearance follows the SEC's dropped case against Ripple, which sparked this wave of institutional interest.

Could XRP Be Managed Like Oil?

XRP, the cryptocurrency that has weathered lawsuits and carved out a niche as both a payment rail and speculative asset, is now drawing comparisons to oil markets. Analyst Brad Kimes suggests Ripple's escrowed reserves could function like OPEC's strategic oil reserves, gradually releasing supply to stabilize prices.

The parallel hinges on control. Just as oil producers adjust output to balance global markets, Ripple's 55 billion XRP escrow could act as a buffer against crypto's notorious volatility. XRP already fulfills two monetary functions—store of value and medium of exchange—with wider adoption as a unit of account potentially following regulatory clarity.

Kimes likens this evolution to the U.S. dollar's post-WWII ascent, a decades-long process of gaining global trust. The key difference: where oil requires physical infrastructure, XRP's digital nature allows for near-instantaneous market adjustments.

XRP Tests Key Support as MAGACOIN FINANCE Gains Traction in Pair Trades

XRP's price action is drawing intense scrutiny as it approaches a pivotal technical juncture. A bull flag pattern on the daily chart suggests potential for a 77% surge to $5 if support at $3.10 holds. The pattern's resolution hinges on a decisive close above $3 resistance.

Meanwhile, MAGACOIN FINANCE emerges as a narrative-driven counterpart to XRP's technical setup. The altcoin is gaining traction in pair trades against major cryptocurrencies, with some speculators eyeing 100x return potential. This divergence highlights the current market's dual appetite for established chart patterns and high-risk, high-reward speculative plays.

XRP Double Bottom Pattern Suggests Potential Rally to Double Digits

Market strategists are eyeing a multi-year double bottom pattern on XRP's chart, fueling speculation of a significant price rally. Despite recent bearish pressure, with XRP dropping 25% from its July peak of $3.65 to around $2.7 earlier this month, some analysts remain bullish on its long-term prospects.

EGRAG, a prominent analyst, contends that XRP could surge to between $22 and $27 if it breaks past its previous high of $3.66. This optimism is bolstered by a confirmed breakout from a double bottom formation dating back to 2018—a technical indicator often signaling a strong reversal.

While skeptics like Crypto Rover suggest a more modest target of $4, the broader market watches closely as XRP trades at $2.82, testing key resistance levels. The coming weeks could determine whether this embattled token defies expectations or succumbs to broader market uncertainty.

Will XRP Price Hit 3?

Based on current technical indicators and market sentiment, XRP appears well-positioned to challenge the $3 resistance level. The price at $2.8813 sits just below the 20-day moving average of $2.8899, while bullish MACD momentum and supportive Bollinger Band positioning suggest upward potential.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $2.8813 | Approaching resistance |

| 20-Day MA | $2.8899 | Immediate resistance |

| Upper Bollinger | $3.0776 | Primary resistance |

| MACD | 0.1219 | Bullish momentum |

Fundamental factors including regulatory resolution, institutional accumulation, and expanding utility through mining features strengthen the case for突破 $3. While technical resistance exists, the combination of positive momentum and supportive fundamentals makes a move above $3 increasingly probable in the near term.